how to pay indiana state tax warrant

Indiana Department of Revenue Indiana Department of Revenue MENU Welcome to the Indiana Department of Revenue Pay your income tax bill quickly and easily using INTIME. We will also notify the Department of State that the tax warrant has been satisfied.

5 17 2 Federal Tax Liens Internal Revenue Service

The filing information is then sent back to the DOR electronically so staff there can send the 3 per filing p See more.

. This Tax Warrant Collection System is designed to help You to make. Plan A is to take care of your taxes early on to avoid penalties and interest a tax warrant and a tax lien on your credit report which stays on your credit for seven years. If you owe a legitimate balance and have the means to pay it in full you should do so at your earliest opportunity.

Follow A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to. Doxpop provides access to over current and historical tax warrants in Indiana counties. The sooner you pay your balance the less additional interest and penalties.

To make an Indiana tax warrant payment online visit the Indiana Taxpayer Information Management Engine IN TIME. Be ready to enter your letter ID or tax. Office of Trial Court Technology.

Property that is illegal to possess. Our service is available 24 hours a day 7 days a week from any location. INcite picks up the file and creates an electronic Judgment Book record of the filing.

A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency. Per Indiana Code 35-33-5-1 a search warrant can be requested and issued to search a place for any of the following. An official website of the Indiana State Government.

Indiana County Sheriffs are required by State Statute to collect delinquent State Tax. Taxpayers must complete the Expungement Request Form and submit any documentation that may support the request. About Doxpop Tax Warrants.

These taxes may be for individual income sales tax withholding. A payment submitted by You through this Tax Warrant Collection System implies Your compliance with the law. Indiana State Tax Warrant Information.

Set up a payment plan by calling 317-776-9860. If your account reaches the warrant stage you must pay the total amount due or accept the. To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to.

Leave a message with the following information. Using the e-Tax Warrant application the DOR provides an electronic file with tax warrants to be processed by Circuit Court Clerks. Your name please spell your name on your message Tax Warrant Number located in the.

Continue recording tax warrant judgments in the judgment docket if not received electronically see IC. You must pay your total warranted balance in full to satisfy your tax warrant. You can set up a.

Questions regarding your account may be forwarded to DOR at 317. Make a payment in person at one of DORs district offices using cash exact change only personal or cashiers check money order and debitcredit cards fees apply Call DOR. Call us at 518-457-5893 during regular business hours and speak with a representative to request we send proof your warrant has been paid in full or if you have other.

Plan B is if you. The court system in Missouri keeps a comprehensive public database hosting warrants court judgments and chargesA requestor may use the platform by entering the last name of the. However circuit clerks using the INcite e-Tax Warrant application or.

Pay Taxes Electronically Pay Taxes Electronically DOR Online Services Pay Taxes Electronically The Indiana Department of Revenue DOR offers multiple options to securely.

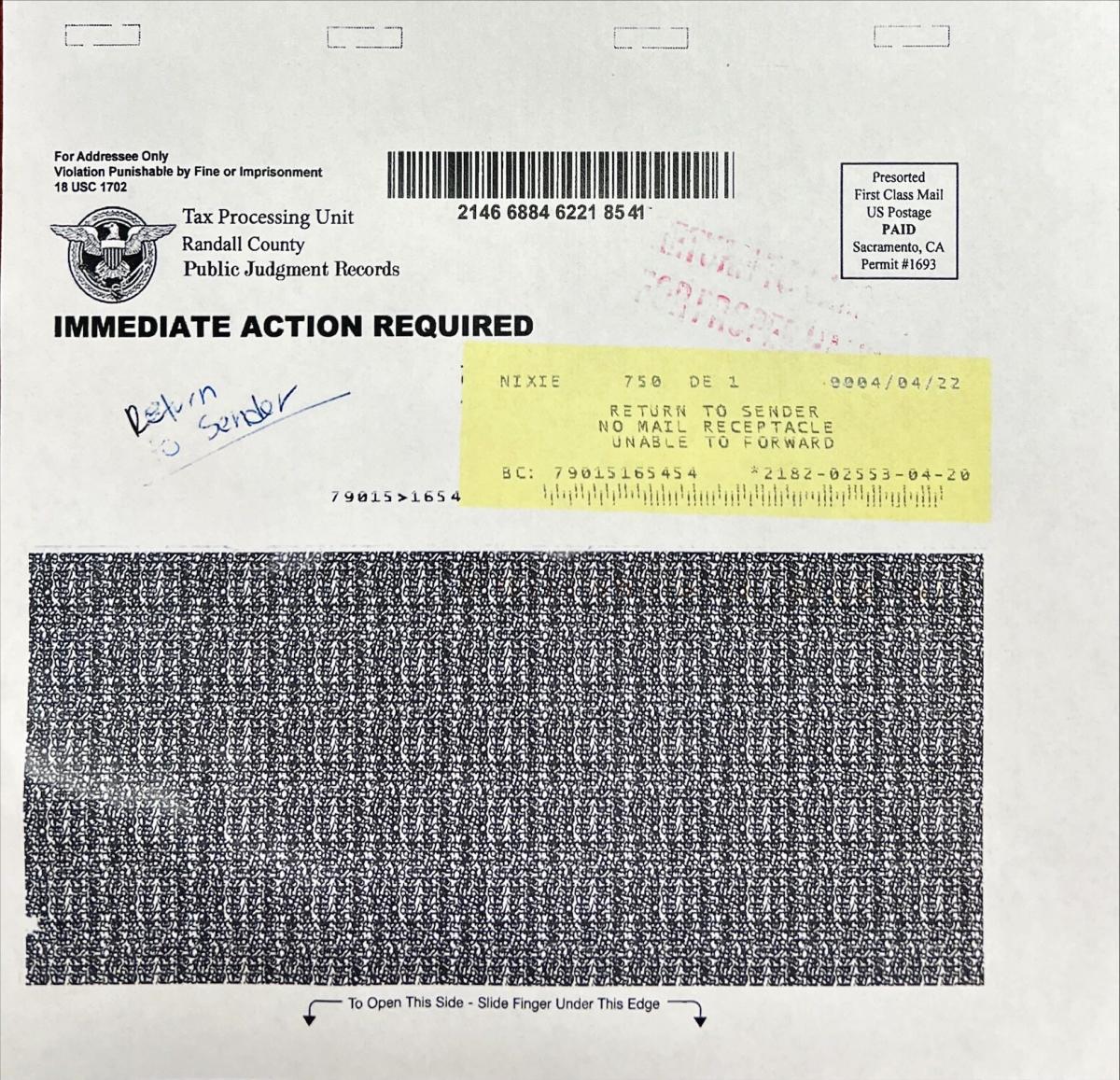

Enterprise Title Don T Be Fooled By Scammers A Homeowner Received This Notice Regarding The Previous Owner Of Their Property Interestingly Enough The Prior Owner Did Have A Tax Warrant Against Them

/cloudfront-us-east-1.images.arcpublishing.com/gray/TT232ZGFP5PGFJDLPW3GFC7OOY.jpg)

Deputies Warn Of New Tax Scam Ahead Of Filing Deadline

Indiana Department Of Revenue Taxpayer Notification Sample 1

New York State Back Taxes Find Out Tax Relief Programs Available

Hoosiers Get Another Month To File Pay 2020 Indiana Taxes Wthr Com

State Tax Lien Removal How To Remove A Tax Lien After Bankruptcy

A Review Of Indiana S State Tax Payment Plan

Indiana Department Of Revenue Taxpayer Notification Sample 1

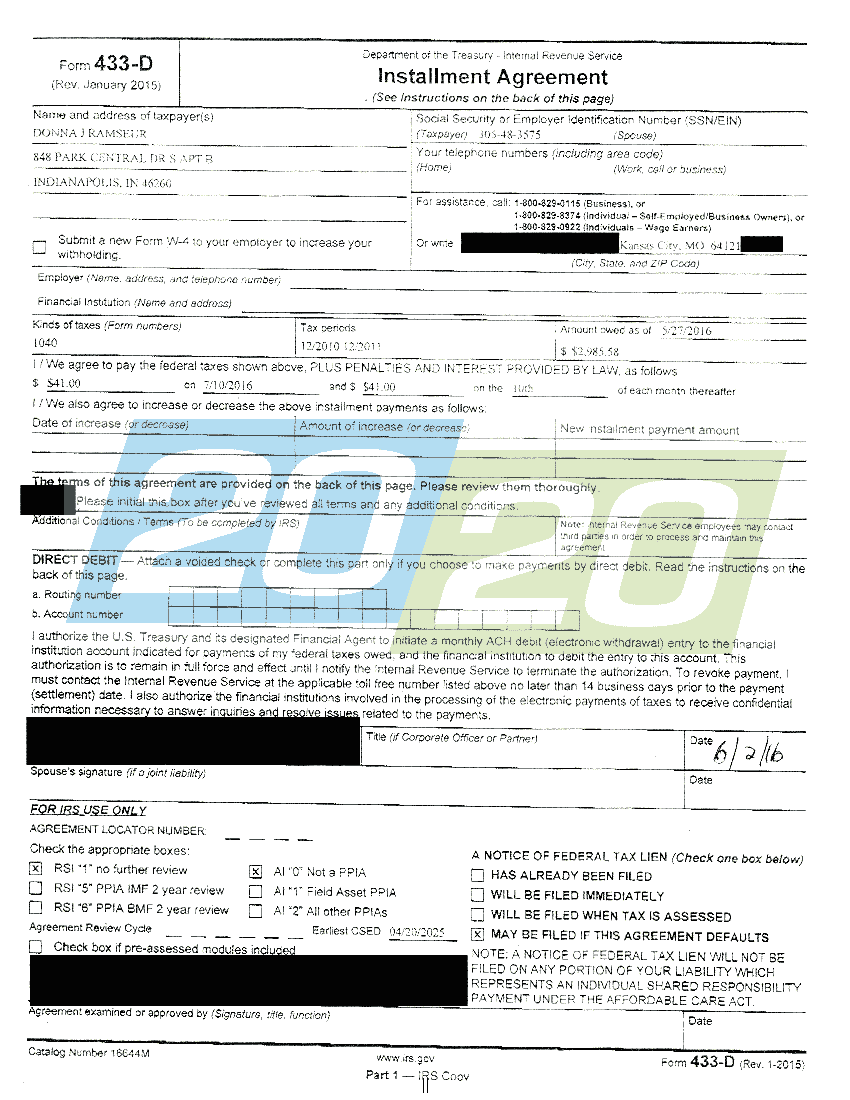

Irs Accepts Installment Agreement In Indianapolis In 20 20 Tax Resolution

Dor Unemployment Compensation State Taxes

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Fraudulent Tax Debt Letters Claiming Distraint Warrant Are A Scam Randall County Says

Application For Renewal Of Alcoholic Beverage Permit 47 Pdf Fpdf Doc Docx

Tax Lien States The Complete List Plus Advice

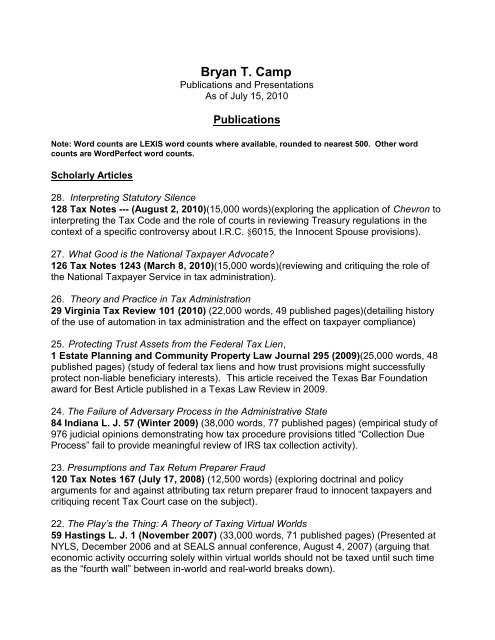

Bryan T Camp Texas Tech University School Of Law

An Overview Of Indiana Tax Problem Resolution Options